BEWARE‼️ OF THE WORD “CLEAN TITLE”.

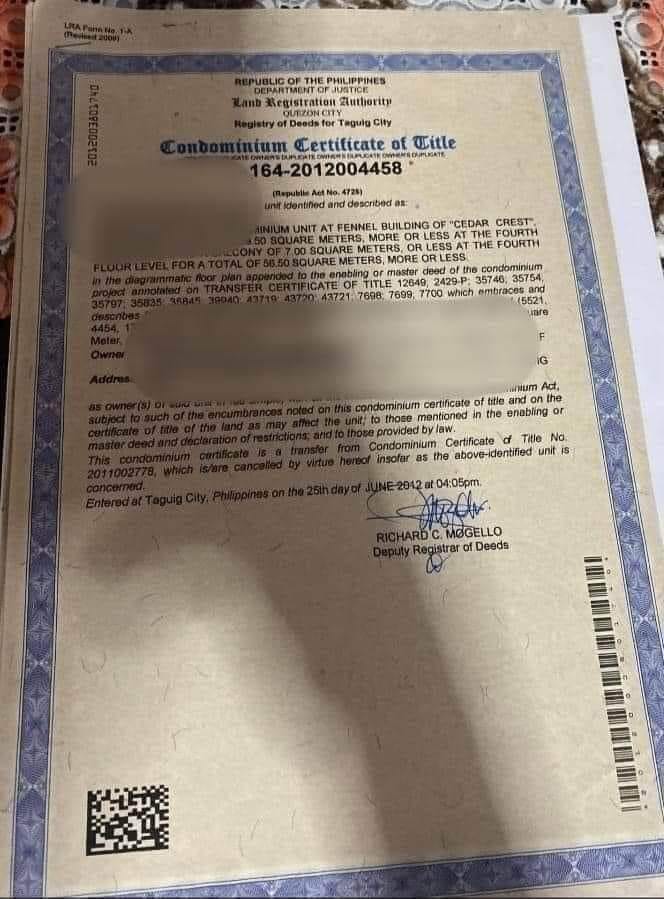

You can only call it clean title IF;

- Owners that appears in the title of the property are still ALIVE & CAN SIGN documents

- NO disputes attached in the title AND “certified true copy” of the title.

?Please take note of the “AND” because not all disputes are printed in the original title itself. - Thus, it is very important to request for the latest certified true COPY of the title.

- All real estate taxes are paid on time. Always request for latest real estate tax clearance.

- The owners are married (on or after 1987) The property is considered conjugal even if only one property owner is in the title. Both should sign sale documents. Should the property owner dies, heirs should file and pay for the estate tax of all the properties.

- The property estate taxes are not yet paid, the property cannot be called “CLEAN”.

- Magkaiba po ang real estate tax na binabayaran ninyo annually at ang estate tax (BIR FORM 1801) You only pay estate tax if the owner in the title is already dead. Penalties (like big penalties) apply for late filing.

Public service lang po ?. Ang estate tax clearance po is NON-NEGOTIABLE. Kailangan talaga syang e file at bayaran whether you like it or not, pag namatay ang owner na nakalagay sa title.

??? FOR YOUR REAL ESTATE REQUIREMENTS, BUYING OR SELLING HIT ME UP ?